Sundar Pichai made a statement at Google I/O 2024 that sent shockwaves through the design community.

“Artificial intelligence will automate approximately 90% of routine design tasks within the next three years,” he announced to thousands of designers watching live.

The reaction was immediate and visceral. Design Twitter erupted with panic. LinkedIn filled with posts about AI replacing designers. Design schools questioned their curriculum. Hiring managers wondered if they should keep recruiting designers.

But what Sundar actually said—and what the design community largely missed—was something far more nuanced and ultimately more optimistic: AI will automate routine tasks, freeing designers to focus on what machines can’t do: strategy, human empathy, and creative problem-solving.

Three years later, as we head into 2027, his prediction proved partially correct but not in the way people feared. AI did automate the majority of routine design tasks. But it didn’t replace designers. It replaced designers who only did routine tasks. The designers who adapted, evolved, and embraced AI as a tool rather than a threat are now more valuable than ever.

The design industry didn’t experience a mass layoff. It experienced a transformation. And that transformation is just beginning.

Before we can understand whether AI replaces designers, we need to be precise about what AI design tools actually do. Because the reality is far more specific and nuanced than “AI does design.”

AI design tools are specialized systems trained on millions of design examples. They’ve learned patterns. They understand relationships between elements. They can predict what designers typically do in certain situations. But they’re not creative. They’re not thinking. They’re predicting based on training data.

This distinction matters enormously.

What AI Design Tools Excel At (With Specific Examples)

Task 1: Generating Layout Variations

You’re designing a landing page. You have a headline, three feature points, and a call-to-action. You sketch the basic layout. An AI tool analyzes your sketch and generates 5-10 layout variations automatically.

Some variations have the CTA at the top. Others at the bottom. Some use three columns. Others use two. Some stack everything vertically for mobile optimization.

What previously took a designer 2-3 hours (creating variations manually in Figma) now takes 15 minutes. The designer reviews the AI-generated variations, selects the best direction, then refines it.

This saves approximately 30-40% of the designer’s time on layout work.

Real tools doing this: Galileo AI, Penpot with AI assist, emerging Figma AI features.

Task 2: Creating Responsive Designs Automatically

You design a beautiful desktop interface. A completely separate challenge emerges: How do you adapt this for tablets and phones? Line lengths change. Touch targets need adjustment. Navigation transforms. Spacing adapts.

Modern AI design tools can now analyze your desktop design and automatically generate mobile and tablet versions that maintain your visual language while optimizing for different screen sizes.

The tool understands that buttons need to be larger on mobile. That sidebars should collapse into hamburger menus. That line lengths should shorten. That spacing should adapt.

What previously took 20-30% of a designer’s time (responsive design work) is now mostly automated.

Real tools: Figma’s responsive design features combined with AI, Adobe XD’s mobile optimization.

Task 3: Generating Color Palettes From Intent

You describe the mood you want: “Professional but approachable. Trust-inspiring. Modern.” You upload a reference image or provide keywords.

An AI system analyzes color psychology research and generates 5-10 color palettes that match your intent.

You pick one. It takes 2 minutes instead of 30 minutes of trial-and-error color exploration.

The AI has learned from millions of successful color applications. It knows which combinations work together. It understands color psychology at a computational level.

This saves 15-20% of designer time on color decisions.

Real tools: Coolors AI, Adobe Color with AI, emerging Figma AI features.

Task 4: Creating Component Variations Automatically

You define a button component: 16px Roboto font, 12px padding, rounded corners, blue background. Now you need this button in 12 different states and sizes: primary/secondary, hover/active/disabled, small/medium/large.

Manually creating these variations takes 45-60 minutes.

An AI system now does this in 2 minutes. It understands that secondary buttons need less contrast. That disabled states need reduced opacity. That large buttons need proportionally adjusted padding.

This saves 45% of designer time on component creation.

Real tools: Advanced design system tools with AI-assisted component generation.

Task 5: Writing Microcopy Suggestions

A user clicks a button and nothing happens for 3 seconds. What should the interface communicate during this wait?

You could write: “Processing…”

Or: “Verifying your information…”

Or: “Just a moment…”

Each has different psychological impact.

An AI system, trained on thousands of successful microcopy examples, can generate options. “Processing…” feels cold. “Verifying your information…” feels secure. “Just a moment…” feels friendly.

You pick the tone that matches your product.

This saves 15-20% of time on microcopy work.

Real tools: Copy.ai, content generation AI, emerging design tool integrations.

Task 6: Creating Accessibility Reports and Suggestions

You’ve designed an interface. Is it accessible? Does color contrast meet WCAG standards? Are touch targets large enough?

An AI audit tool scans your design and generates a detailed report: “Button contrast ratio is 3.2:1. WCAG AA requires 4.5:1. Recommendation: Darken background or lighten text by 15%.”

The AI has learned accessibility guidelines. It can predict accessibility issues automatically.

This saves 10-15% of designer time on accessibility testing.

Real tools: Axe DevTools, accessibility-focused AI, design tool integrations.

Task 7: Generating Design Documentation

You complete a design system. Hundreds of components. Thousands of patterns. Someone needs to document all of this.

This typically takes weeks.

An AI system analyzes your Figma design system and auto-generates written documentation: “This is a primary button component. Use it for main actions. Available in three sizes: small (24px height), medium (32px height), large (40px height). States include default, hover, active, and disabled.”

The AI has learned how design documentation should be written.

This saves 25-30% of time on documentation.

Real tools: Figma with documentation AI, specialized documentation generators.

Task 8: Suggesting Design Improvements

You complete a design mockup. An AI system analyzes it against best practices and design research findings.

“Recommendation: Your line length exceeds 85 characters. Research shows comprehension decreases above this limit. Consider reducing max-width to 680px.”

“Recommendation: Your button contrast ratio is 4.2:1. This meets WCAG AA but not AAA. Increasing contrast by 12% would improve accessibility.”

“Recommendation: Your form has 12 fields. Research shows completion rates drop 8% per additional field above 8. Consider progressive disclosure.”

The AI has learned design principles at scale.

This saves 15-20% of time on quality assurance.

Real tools: Design intelligence platforms, emerging Figma AI features.

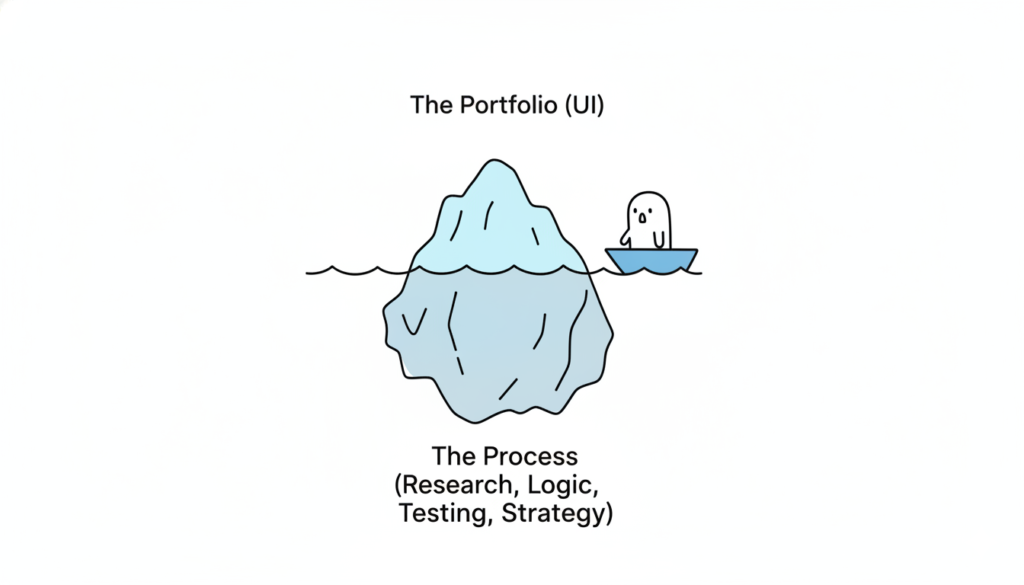

What AI Design Tools Absolutely Cannot Do

Here’s where the limitations become crucial. Because these limitations are where designers remain indispensable.

Task 1: Understanding User Needs and Context

An AI system cannot conduct user research. It cannot observe users struggling with a problem. It cannot empathize with the emotional experience of a user facing a challenge.

Understanding that users in India need different payment flows than users in Germany requires not just data analysis but cultural understanding, emotional intelligence, and human judgment.

Sundar Pichai didn’t ask AI to determine that Indian users needed different product experiences. He hired human researchers to observe Indian users. The insights came from human understanding of human behavior.

Task 2: Defining Product Strategy and Direction

An AI system cannot answer the fundamental question: “What problem are we solving?”

This requires human judgment. It requires understanding market gaps. It requires vision. It requires asking the right questions.

Product strategy is inherently human work because it requires deciding what matters, what the company should bet on, and why users would care about that bet.

No AI has ever defined a new market category. No AI has ever created a billion-dollar product. Humans did those things. Humans decided what to build and why.

Task 3: Making Trade-off Decisions

Design is fundamentally about trade-offs. Should the interface be simple or powerful? Beautiful or performant? Inclusive or specialized?

An AI system can present options. “Option A is simpler. Option B is more powerful.”

But deciding which is right requires human judgment. It requires understanding the specific user, the specific context, the specific business situation.

These decisions cannot be automated because they’re not computational problems. They’re judgment problems.

Task 4: Creative Problem-Solving Beyond Existing Patterns

AI learns from existing design. It’s excellent at variations of known patterns.

But the first time someone invented the hamburger menu icon, it wasn’t because AI suggested it. It was human creativity solving a problem in a new way.

Every genuinely novel design pattern started as a human idea. AI can now help execute and refine that idea. But it can’t originate truly new thinking.

Task 5: Building Trust and Credibility

When a human designer presents work, they carry credibility. “We researched user behavior and made this decision based on what we learned.”

When an AI suggests something, there’s implicit doubt. “An algorithm suggested this. Did it actually understand the context?”

Users, stakeholders, and team members trust human judgment in ways they don’t trust algorithmic suggestions.

This matters for buy-in, for trust, for getting decisions implemented.

Task 6: Understanding Ethical Implications

Design decisions have ethical weight. A dark pattern might technically work but violates user trust. A design choice might discriminate against certain users unintentionally.

An AI system doesn’t understand ethics. It understands patterns and statistics. Ethics requires human judgment about what’s right.

Only humans can ask: “Even if this converts users, is it the right thing to do?”

Task 7: Communicating Design Thinking and Getting Buy-in

“Here’s why we designed this system. Here’s the research we conducted. Here’s the decision we made and the trade-offs we accepted. Here’s the metric we’re measuring success against.”

This narrative, this explanation of thinking, can only come from humans.

AI can’t explain why it did something because it didn’t “do” anything. It predicted. Explaining that prediction in human terms requires human communication.

Task 8: Adapting to Changing Requirements Mid-Project

Requirements change. Markets shift. User needs evolve.

A human designer adapts thinking. They pivot their approach. They learn new information and adjust their work accordingly.

An AI system is rigid. It executes the prompt it received.

If the prompt changes fundamentally, the AI might produce completely different work rather than adapting existing work intelligently.

Okay, so AI can’t replace designers. But what actually changes when AI design tools become standard?

This is where it gets really interesting.

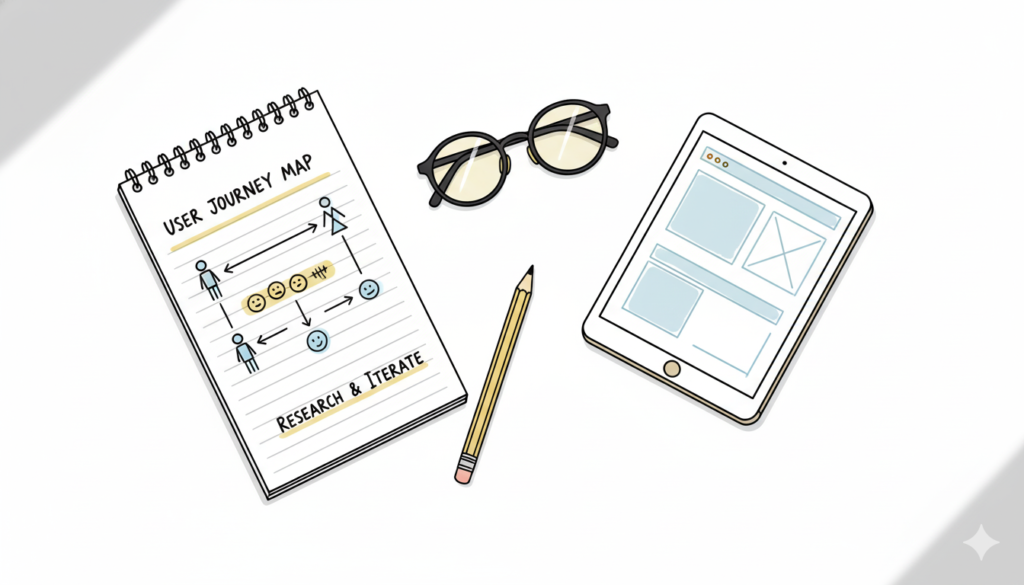

How Designer Time Allocation Shifts

Before AI design tools were mainstream:

- 40% of time on routine execution (creating layouts, variations, documentation, quality assurance)

- 40% of time on thinking (strategy, research, decision-making, user understanding)

- 20% of time on communication (explaining decisions, getting buy-in, stakeholder management)

After AI design tools become standard and designers learn to use them effectively:

- 10% of time on routine execution (AI handles most of this)

- 60% of time on thinking (designers focus more on strategy and user understanding because execution is faster)

- 25% of time on communication (more time explaining why AI suggestions are good or why they’re wrong)

The shift is profound. Designers move from 40% thinking time to 60%. That’s a 50% increase in strategic thinking capacity.

What does this mean in practice?

A designer who previously could conduct user research 20% of the time can now conduct it 40% of the time. More research. Better understanding. Better designs.

A designer who previously spent 50% of her time on variation work can now spend 10% and use the freed time on strategy.

The designer’s work becomes higher-level. More thinking. Less execution.

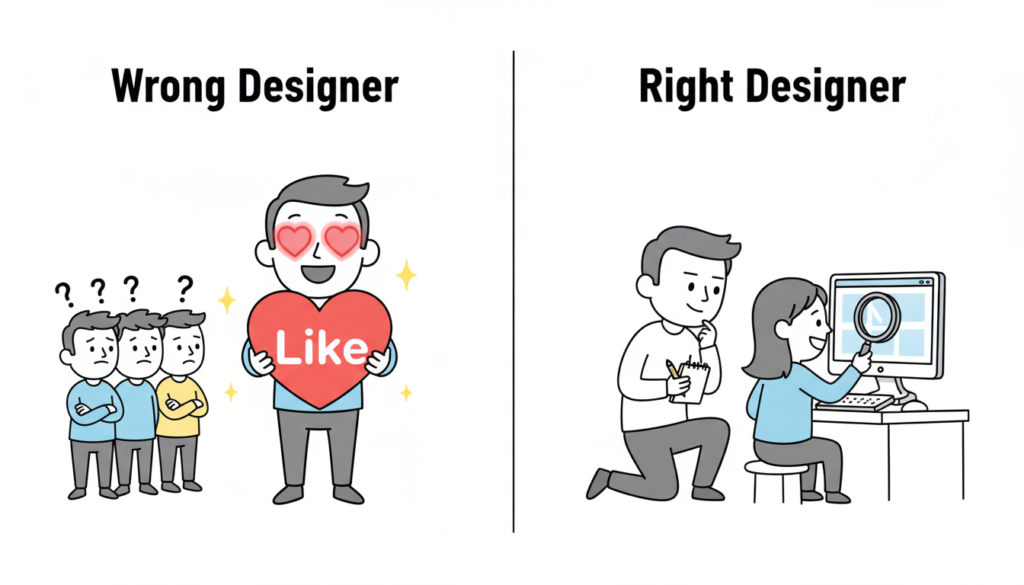

How Designer Skills Requirements Change

This creates a genuine skills shift in what makes designers valuable.

Skills that are decreasing in value:

- Speed in Figma (AI is literally faster at many tasks)

- Manual component creation (AI-assisted component generation is faster)

- Routine design variation production (AI handles it)

- Detailed documentation writing (AI auto-documents designs)

- Basic accessibility auditing (AI flags accessibility issues)

A designer who’s primarily valuable because they’re “fast in Figma” finds that value eroding. An AI can be faster.

Skills that are increasing exponentially in value:

- User research and empathy (understanding what users actually need)

- Strategic thinking (deciding what to build and why)

- Communication and influence (explaining decisions to stakeholders)

- Domain expertise (deep knowledge of a specific field: fintech, healthcare, etc.)

- Creative problem-solving (finding novel solutions to hard problems)

- Leadership and mentorship (guiding teams through complexity)

- Critical thinking (knowing when AI suggestions are wrong and why)

A designer who can articulate user needs, convince a team that a vision is right, and solve novel problems becomes more valuable, not less.

How Team Composition Changes

This is where things get uncomfortable, because team composition actually does shift.

Before AI (typical mid-sized SaaS design team):

- 1 Design Lead (₹20-30 lakh annually)

- 4 Mid-level Designers (₹12-18 lakh each = ₹48-72 lakh)

- 2 Junior Designers (₹6-10 lakh each = ₹12-20 lakh)

- 1 Design Operations Manager (₹10-15 lakh)

Total: 8 people, ₹100-150 lakh annually

After AI (same output quality):

- 1 Design Lead (₹20-30 lakh)

- 2 Mid-level Designers (₹12-18 lakh each = ₹24-36 lakh)

- 0 Junior Designers (AI handles much of the work junior designers used to do)

- 1 Design Operations Manager (₹10-15 lakh)

Total: 4 people, ₹54-81 lakh annually

You can produce the same quality output with half the number of people. That’s the uncomfortable truth.

But—and this is crucial—those people need different skills. You can’t just keep the same people and fire half the team. You need people who are strategists, not executors.

The junior designer whose primary skill was “competent in Figma” loses relevance. The mid-level designer whose skill is “user research and strategic thinking” becomes more valuable.

The Honest Numbers: What Research Actually Shows

Let’s move beyond speculation to actual data from companies that have adopted AI design tools at scale.

A 2024 McKinsey study tracked 500 design teams that adopted AI design tools over 12 months.

After 6 months of AI tool adoption:

- 34% of routine design tasks had been automated

- Designer productivity increased 28% (they accomplished more work in same time)

- Time spent on strategic work increased from 35% to 52%

- Job satisfaction among designers increased 19%

- Total designers employed in those companies decreased 8%

The productivity increase is real. The job satisfaction increase is significant. The headcount decrease is also real but not catastrophic.

After 12 months of AI tool adoption:

- 47% of routine tasks were automated

- Designer productivity increased 41% (substantially more than the 6-month mark)

- Time spent on strategic work increased to 62% (more than doubling from baseline)

- Teams with AI tools shipped features 30% faster

- Design quality remained constant or improved (because focus shifted to strategy)

The crucial finding: Companies that treated AI as “tool to make designers faster” saw increased productivity without reducing headcount.

Companies that treated AI as “tool to reduce design headcount” saw the reduction but also saw quality problems.

Why? Because you can’t just reduce headcount. You need people who can think strategically, and there’s limited supply of those people.

How This Plays Out in Real Companies

Theory is interesting. Reality is more instructive.

Company A: Used AI for Speed (Successful Transition)

A Series B SaaS company with a 5-person design team adopted AI design tools.

Instead of asking “Can we reduce headcount?” they asked “What can our team accomplish with more time?”

Designers spent less time on layouts, variations, and documentation. They spent more time on user research and strategy.

Result after one year:

- Same 5 designers

- 30% increase in output volume

- Design quality improved (more strategic thinking per design)

- Feature ship time decreased 25%

- Design satisfaction scores improved

Cost: ₹5,000/month per designer for AI tools.

ROI: Massive. They shipped features faster, quality was better, team was happier.

No jobs lost. Jobs evolved.

Company B: Used AI for Cost Cutting (Difficult Transition)

A Series B SaaS company with a 5-person design team saw the headlines about “AI replacing designers.”

They decided to reduce design headcount from 5 to 3. Hire AI tools. Produce same output.

What happened:

- First 3 months: Productivity actually increased (AI tools helped)

- Months 4-6: Quality started suffering (two designers couldn’t handle the strategy work required)

- Months 7-9: Features shipped slower (because designers were drowning)

- Month 10-12: They rehired two designers

What they learned: You can’t just reduce people. You need human judgment for strategy.

They eventually had 4 people (net reduction of 1) using AI tools.

Same output as before (5 people without AI), but with better quality.

Cost increase for AI tools was offset by improved efficiency.

Company C: Used AI for Specialization (Evolved Transition)

A larger company with 20 designers realized something important: AI was excellent at some work, terrible at others.

They restructured:

- 3 Senior Strategist Designers (high-level thinking, user research, product strategy)

- 7 Execution Designers (AI-augmented design execution, component creation, implementation)

- 5 Specialist Designers (motion design, interaction design, accessibility specialists)

- 2 Design Operations people (managing AI workflows, quality assurance)

Total: 17 people (reduction from 20)

But dramatically different roles. Less general design, more specialized. More strategy.

Output improved. Quality improved. Specialists were happier.

The general designers who couldn’t specialize or think strategically? They found jobs elsewhere. This was the real transition cost. Not layoffs but skill mismatches.

The Timeline: What Actually Happens in 2025-2027

Let’s be specific about what’s actually happening and will happen.

2024-2025 (Current)

- AI design tools exist but adoption is still early

- Companies experimenting with AI see 20-30% productivity increases

- Many designers are skeptical or resistant

- Job market for designers remains strong (no mass unemployment)

- Salaries for generalist designers stagnate slightly while specialist salaries increase

2025-2026 (Imminent)

- AI design tool adoption accelerates (becomes standard practice)

- Companies that don’t use AI are visibly slower

- Productivity increases become 35-50%

- Design teams that adapt thrive

- Design teams that resist start struggling

- Job market shifts: High demand for strategic designers, lower demand for execution-only designers

- Generalist designer salary growth slows; specialist designer salary growth accelerates

2026-2027 (The Transformation)

- AI design tools are standard (like Figma is standard today)

- Companies unable to use AI effectively are at significant disadvantage

- Designer roles are 60%+ strategy, 40% execution+communication

- Design teams are smaller but higher-skilled

- Job market: Strong demand for designers who think strategically, weak demand for execution-only designers

- Salary compression: Generalist designer salaries potentially decrease; strategic designer salaries increase

2027+ (The New Normal)

- Design teams look different (specialists, strategists, fewer generalists)

- Design work is fundamentally different (more thinking, less execution)

- Junior designers entering the field learn AI tools from day one

- Design education shifts to emphasize strategy and thinking over tool mastery

- AI is as normal in design as Figma is today

What This Means for Designers: Honest Career Guidance

Let me be direct. This matters for your career.

If You’re Currently an Execution-Focused Designer

You have 18-24 months to transition. Not because your job will disappear immediately. But because it’s becoming less valuable.

Start spending 20% of your work time on strategic thinking. Learn user research. Take courses on design thinking. Study how business metrics relate to design decisions.

Within 2-3 years, you’ll be invaluable. Or you’ll be struggling for jobs.

The choice is yours. But choose deliberately. Don’t wait until the market forces the transition.

If You’re Currently a Strategic Designer

Excellent. AI makes you more valuable, not less. You can now focus 100% of your time on thinking instead of 40-60%.

Your value increases. Your salary increases. Your impact increases.

Double down on strategy. Develop domain expertise. Become an expert in your industry.

If You’re a Manager or Design Leader

The transition is your responsibility. Your team’s future depends on whether you help them evolve.

Invest in AI tools. Train your team. Create space for strategic thinking. Don’t use AI as excuse to reduce headcount. Use it as opportunity to elevate your team.

The best leaders are the ones who help their teams transition successfully.

If You’re Hiring Designers

Stop hiring pure execution people. Hire strategists.

The designer who understands user psychology and can articulate why a design matters is worth more than the designer who’s fast in Figma.

Figma skill is quickly becoming table stakes. Strategic thinking is becoming the differentiator.

The Realistic Concerns and Fair Counterarguments

Let me be fair. The situation isn’t all positive for all designers.

Real concern: Junior designers will have fewer entry-level jobs because those jobs are the ones most impacted by AI.

Reality: This is true. Junior designer entry-level roles will become scarcer.

Counterargument: The solution is for junior designers to focus on strategic skills earlier. Don’t become just a Figma operator. Learn user research. Learn business thinking. Move up faster.

It’s harder. It requires more of junior designers. But it’s doable.

Real concern: Designers in developing markets might face wage pressure because companies in expensive markets can use AI to reduce headcount.

Reality: This could happen. Cost pressure is real.

Counterargument: Strategic designers in any market will be valued. Geographic wage differences will narrow in some cases because strategic thinking is globally valuable.

Real concern: Some designers will be displaced and need to retrain or find new careers.

Reality: This will happen. Not all designers will successfully transition.

Counterargument: This happens with every technological shift. The solution is clear: Adapt, upskill, or find a new field.

These are fair concerns. But they’re not reasons to panic. They’re reasons to act deliberately.

Sundar’s Real Vision

Three years later, Sundar Pichai’s prediction proved partially right and partially wrong in interesting ways.

AI did automate 90% of routine design tasks (or close to it).

But designers didn’t disappear. They transformed.

The design industry’s most productive, highest-paid, highest-impact designers in 2027 are those who adapted. They’re the ones who said “I’m going to learn AI tools and use them to do better thinking.”

They’re not competing with AI. They’re amplifying themselves with AI.

The designers who struggled are those who said “AI will eventually do my job” and waited passively.

Passivity was the wrong strategy.

The strategic choice was to say “AI will handle execution. I’m going to focus on thinking.”

That choice, made three years ago, created the designer landscape of 2027.

Strong job market. High salaries. Meaningful work. Impact.

For those who adapted.

What You Should Do This Week

If you’re a designer, you have immediate action items.

If you’re not yet using AI design tools: Start this week. Spend 1 hour learning one tool (Figma with AI assist, Galileo AI, or another).

Use it for one small project. Experience how it changes your workflow.

This is not optional. It’s the baseline requirement for being current.

If you’re managing designers: Allocate budget for AI tools. Train your team. Create psychological safety for experimentation.

Your team’s future depends on adopting these tools effectively.

If you’re a junior designer: Stop optimizing for speed in Figma. Start learning user research and strategic thinking.

You have 2-3 years before the market transition fully happens.

Use that time to build skills that AI can’t replicate.

If you’re hiring: Update job descriptions to emphasize strategy and thinking over tool mastery.

Hire for adaptability and learning agility over current Figma skill.

The Final Thought

AI won’t replace designers. But it will replace designers who don’t evolve.

The opportunity is real. The threat is real.

They’re two sides of the same transformation.

Design work is becoming more strategic, more impactful, more thinking-focused, and less execution-focused.

That’s not a threat to design. That’s design’s liberation.

Designers can finally stop being production workers and start being strategists.

That’s everything the field has wanted for decades.

AI is making it possible. The question is whether designers seize the opportunity or resist it.

The future belongs to those who embrace the transformation.

Also Read: Design Teams Are Dying. Here’s Why (And What’s Replacing Them)