Nearly 90% of fintech users drop off during onboarding. Not because products are bad. Because the experience breaks trust before users ever move money.

This statistic haunts fintech founders. But most never dig deeper. They assume users aren’t ready. The problem isn’t readiness. It’s friction hidden inside every screen.

A UX audit reveals what no amount of guessing can uncover.

Understanding the Fintech Drop-Off Problem

Think about what fintech asks users to do upfront:

Verify identity. Upload government ID. Answer security questions. Connect bank accounts. Accept compliance disclosures. All before accessing a single core feature.

Most apps require this sequentially. Users see long forms and abandon before finishing.

Research from Plaid’s customer base shows drop-off rates range from 20% to 88% depending on design. The difference? How well the experience explains what’s happening and why.

When compliance becomes friction instead of clarity, users leave. When security feels paranoid instead of protective, they go elsewhere.

Why Generic Audits Fail Fintech

Standard UX audits focus on usability. Does the button work? Is the navigation clear? Fintech needs more.

Fintech audits must answer different questions:

Does the app clarify what will happen with personal data? Does it explain why KYC is necessary before requesting it? Does it offer resume options if users get interrupted? Does it handle errors gracefully or blame users? Does it show progress or leave users wondering how many more steps remain?

A proper fintech audit connects every friction point to business metrics. Not design preferences.

How Real Companies Fixed Their Onboarding

Robinhood simplified by deferring configuration. Users open an account and immediately access trading. Account setup happens later. This removes a major friction point without sacrificing functionality.

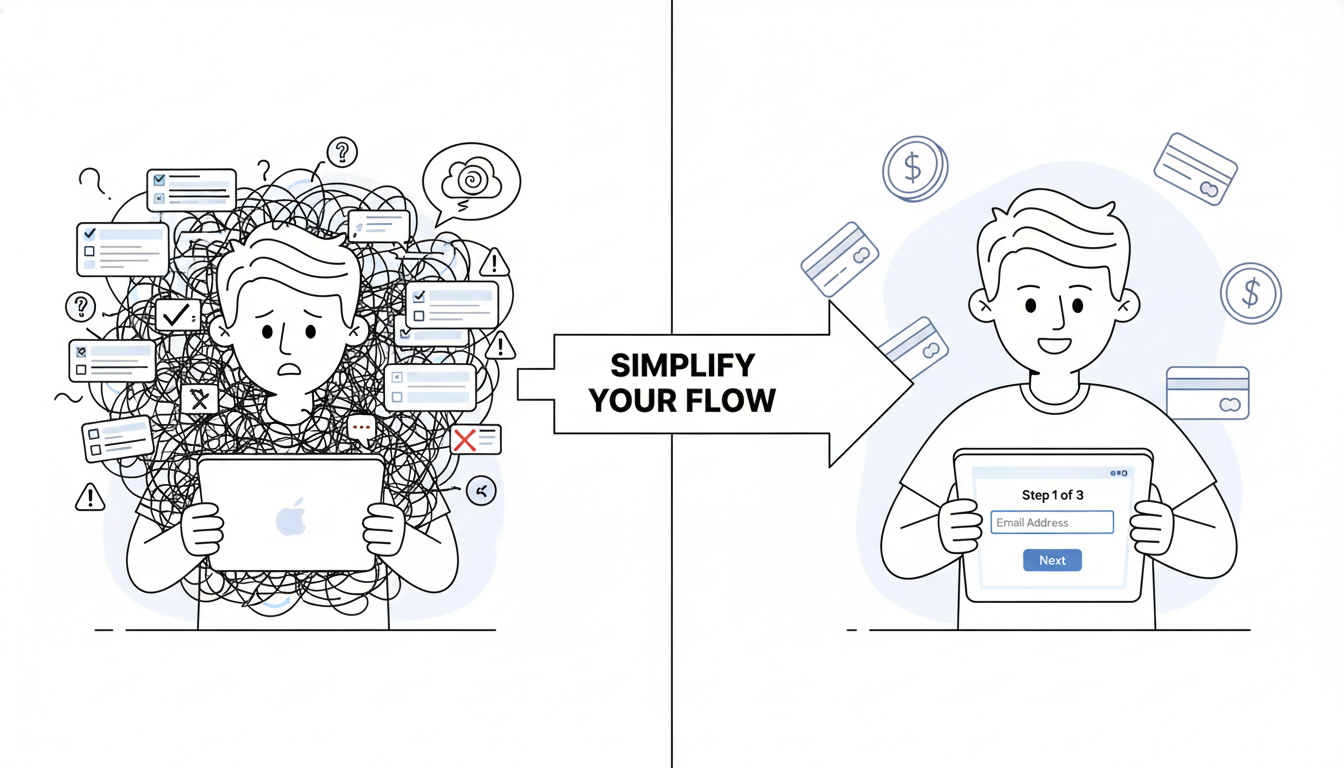

Chime breaks onboarding into single-question screens. One field per page. This reduces cognitive load. Users complete faster because they’re not overwhelmed by choices.

Stripe optimized their KYC process for speed. Identity verification completes in minutes, not hours. They removed unnecessary fields, improved verification algorithms, and added real-time feedback.

What connects these approaches? They removed complexity without removing security.

The Audit Process That Actually Works

Step one focuses on scope. Don’t audit the entire app. Focus on flows that impact revenue: onboarding, first transaction, account activation. These are conversion gates.

Step two involves data gathering. Pull analytics on where users drop off. Analyze session replays. Review support tickets. Find patterns in where users struggle.

Step three requires usability testing. Recruit five real users. Give them tasks. Watch them try to complete onboarding without your help. Don’t guide them. Observe where they pause, get confused, or give up.

Step four evaluates against fintech principles. Does the experience explain security clearly? Does it show why data requests are necessary? Does it build trust or create doubt?

Step five prioritizes by impact. Which issues hurt conversion most? Fix those first. Ignore cosmetic problems. Focus on behavior-change problems.

Step six maps findings to business metrics. Connect every fix to concrete results like onboarding completion rate, KYC success rate, support volume, or account activation speed.

One Example That Shows Impact

A lending platform discovered their problem wasn’t the payment interface. It was onboarding asking for six pieces of information simultaneously.

Applicants saw the form and bailed. Too much upfront. Too many fields. Too overwhelming.

The fix was simple: break it into six screens. One question per screen. Same information collected. Different experience.

Completion rate jumped from 23% to 78%. Support tickets for “how do I apply” dropped 80%. Application volume increased 250%.

This didn’t require redesigning the product. It required understanding user behavior and prioritizing what mattered most.

Why Most Audits Fail

Fintech teams often confuse an audit with design feedback. They show screens to a designer. The designer suggests changes. They call it an audit.

That’s not an audit. That’s opinion.

A real audit measures user behavior. It tracks where people actually get stuck, not where designers think they should. It connects findings to business outcomes.

Common failure points:

Teams audit everything instead of focusing on conversion gates. They gather data but don’t watch real users interact with the product. They don’t prioritize fixes by business impact. They treat compliance as unavoidable friction instead of an opportunity to build trust.

What Changes When You Get This Right

When fintech teams run proper audits, several things shift.

Onboarding completion improves because each step clarifies rather than confuses. Support costs drop because users understand the process without calling for help. Conversion rates rise because trust builds through transparency. Retention improves because users feel confident the app protects their interests.

These aren’t design outcomes. They’re business outcomes.

Starting Your Audit Tomorrow

Pull your analytics today. Find your biggest drop-off point during onboarding. That’s where your audit begins.

Record a session replay of a user struggling at that exact spot. Watch what goes wrong. Ask yourself: is this friction necessary or accidental?

Necessary friction (like identity verification) can be explained clearly. Accidental friction (like unclear form fields) should be removed.

Run a quick usability test. Give five users a task. Watch where they pause. That tells you what’s genuinely confusing.

The companies winning fintech right now aren’t winning because of clever features. They’re winning because they optimized the parts that matter most: trust, clarity, and ease.

An audit shows you exactly where to focus.

Also Read: Clean Design – Why Removing Features Makes Better Products